Direct selling in the United States - 2020

A year in review by the U.S. Direct Selling Association

Direct Selling Association in the U.S. recently announced the findings of its Growth and Outlook study 2020. Looking into the various factors and developments impacting the U.S. direct selling industry, DSA’s curated findings benefit direct selling organizations to effect them in their business. DSA conducts the study every year to estimate the size and scope of the industry in the U.S. In 2019, their study on differing attitudes of US consumers towards direct selling had gained much attention. This year’s results showcase the silver lining of the direct selling industry in the prevalent times of the pandemic upsurge.

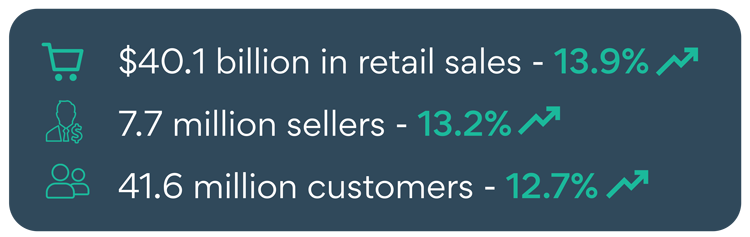

The American direct selling industry exhibited a record high of $40.1 billion in retail sales this year. The industry has manifested the power in itself despite the crisis caused by the pandemic.

The 7.7 million figure includes both full-time and part-time direct sellers who sell products or services to consumers and/or sponsor people to join their team. The industry also has to its credit 41.6 million preferred customers and discount buyers. This in addition to the direct seller figures.

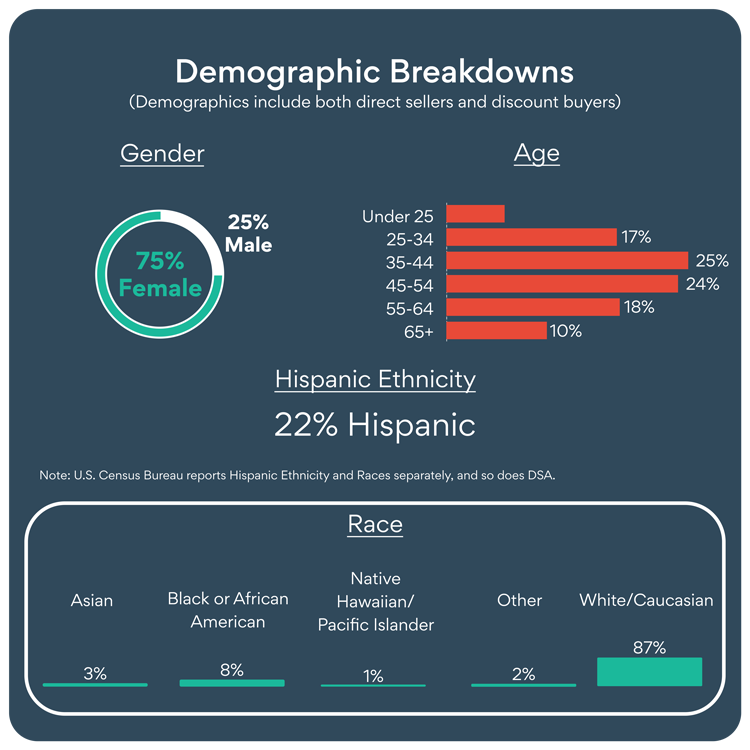

The breakdown of the numbers will give us a broader view of the direct selling populace.

Industry leaders expressed their positive belief in the vivacious potential of the industry that stands unwavering amidst the pandemic slowdown in today’s economy.

“America is forever changing, no more so than during the last year. Direct sellers have proven themselves time and again to be nimble microentrepreneurs, willing and able to serve their customers and communities within a changing environment,” shared Joseph N. Mariano, President, Direct Selling Association.

Mariano remarked his confidence in the capability of the direct selling industry even during these times of economic downturn, “The direct selling companies also adapted quickly to a world with changing needs by empowering their independent sellers with the tools to serve their customers and fellow sellers – innovative technology, updated health and safety policies, and second to none business support. During this time of uncertainty, Direct Selling Association and its members also worked to ensure that customers and salespeople alike can rely upon the highest level of business ethics. The results are clear – a record breaking year and an unequivocal demonstration that direct selling is dedicated to serving America.”

Discover the success story of leading direct selling companies in USA.

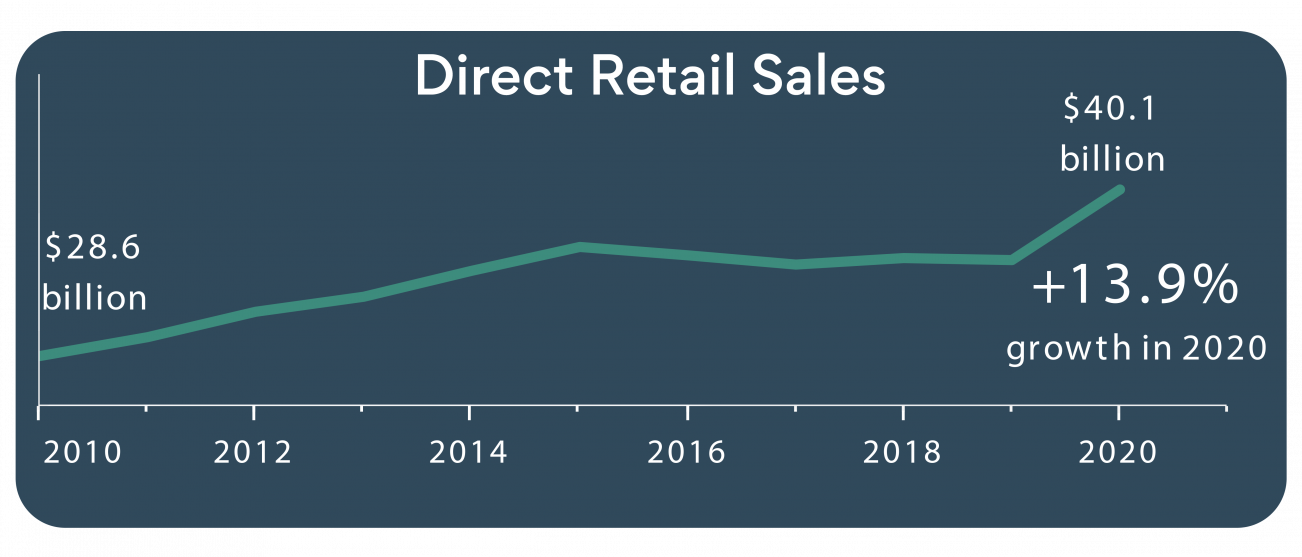

Direct retail sales

The industry has evolved through the challenges exhibiting a 40.2% growth in retail sales over a period of 10 years. While there is a multitude of factors contributing to the progress of the industry over the years, it’s the steadfastness even in the face of cultural and economic diversity that contributed to the growth.

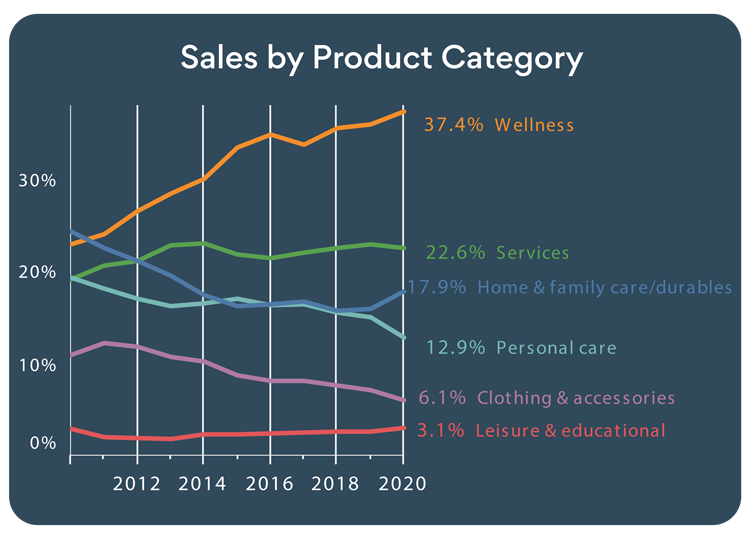

Sales by product category

A slight increase in sales was reported by the wellness industry with a 1.4% increase compared to the previous year which could be attributed to the people’s concerns on health and wellness stirred up by the pandemic.

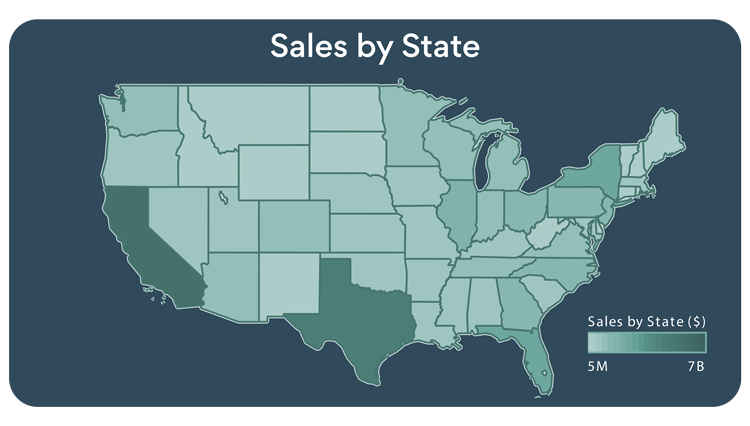

Sales by state

The US states were marked by sales ranging from 5 million upto 7 billion. California and Texas topped the 2020 sales among the other US states.

Demographic analysis

The recurrent practice of women dominating the direct selling crowd prevailed, with 75% female population outnumbering the 25% male direct sellers. The demographic reports show that middle-aged people are more drawn towards direct selling than the younger generations.

Direct Selling U.S. - Recent years in comparison

| 2020 | 2019 | GROWTH RATE | |

|---|---|---|---|

| Retail sales | $40.1 billion | $35.2 billion | 13.9% |

| Direct sellers | 7.7 million | 6.8 million | 13.2% |

| Customers | 41.6 million | 36.9 million | 12.7% |

| Average sales per direct seller | $5208 | $5176 | .61% |

The DSA’s Growth and Outlook study conducted annually is audited by Nathan associates, a third-party international economic consulting firm.

“Since 1995, Nathan Associates has been proud to work with the DSA analyzing the Growth & Outlook Survey data and conducting extensive secondary research to develop industry-wide estimates for the U.S. direct selling industry,” said Paul Bourquin, Principal at Nathan Associates. “As a third-party international economic consulting firm, we deliver methodologically sound industry-wide estimates to help DSA serve as a trusted source of data on the full direct selling channel in the U.S.”

Direct Selling Association in the U.S. has been striving constantly to support, protect and educate the direct selling community about the industry and market trends in the United States. DSA runs researches and surveys collaborating with other DSA committees, the Direct Selling Education Foundation, the World Federation of Direct Selling Associations, and external research firms to measure the capacity of the direct selling industry, its year-on-year growth rate, and operating benchmarks to measure marketplace effectiveness. The regulatory body oversees the activities of its member companies and ensures that the community adheres to strict legal and regulatory standards.

Source: DSA Growth and Outlook study 2020

Leave your comment

Fill up and remark your valuable comment.